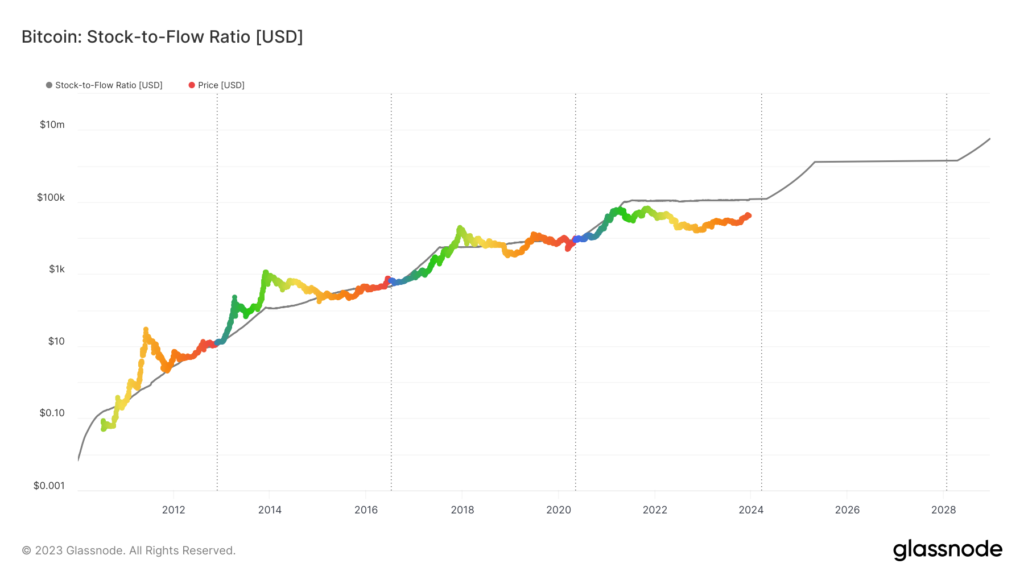

In the ever-evolving realm of cryptocurrency, few concepts have garnered as much attention and debate as PlanB’s stock-to-flow (S2F) model. The S2F model aims to predict Bitcoin’s future price fluctuations by analyzing its scarcity relative to its growth rate. While not without its critics, the S2F model has gained traction for its ability to accurately forecast price movements following Bitcoin’s halving events.

The S2F model has also been applied to other assets, including gold and silver. The rationale behind this extension lies in the underlying principles of scarcity and growth. Assets with limited supply and slow growth tend to exhibit higher S2F ratios, suggesting greater scarcity and, consequently, higher intrinsic value.

Understanding the S2F Model

The S2F model measures the scarcity of an asset by dividing its current stock (total supply) by its annual flow (new supply). In the context of Bitcoin, the stock represents the total number of bitcoins in circulation, while the flow represents the amount of newly minted bitcoins per year. By calculating this ratio, the S2F model provides a gauge of an asset’s scarcity and potential for price appreciation. The S2F model has historically been a good predictor of gold prices. For example, the S2F ratio for gold doubled between 2000 and 2008, which coincided with a period of strong gold price appreciation.

Past Performance and Future Outlook

Since its inception, the S2F model has demonstrated remarkable accuracy in predicting Bitcoin’s price movements following halving events. Halvings, which occur approximately every four years, reduce the block reward miners receive for validating transactions. This deflationary mechanism has historically been accompanied by significant price spikes.

PlanB’s model reveals a consistent trend of increased Stock-to-Flow (S2F) ratios following Bitcoin halving events, resulting in significant price surges. For instance, after the 2012 halving, the S2F ratio doubled, coinciding with a price surge from $13 to $1,100 (+8361%). Similarly, the 2016 halving saw a threefold increase in the S2F ratio, driving Bitcoin’s value from $664 to a record high of $20,000 (+2912%) in 2017. The 2020 halving continued this pattern, contributing to an upward trend from $9,734 and peaking at $67,549 (+593%) in 2021.

While the stock-to-flow model provides a valuable framework for price forecasting, it is crucial to acknowledge its limitations. The model solely focuses on supply, neglecting the influence of demand, which can significantly impact Bitcoin’s price. Additionally, unpredictable factors like regulatory developments and black swan events can throw off even the most sophisticated models.

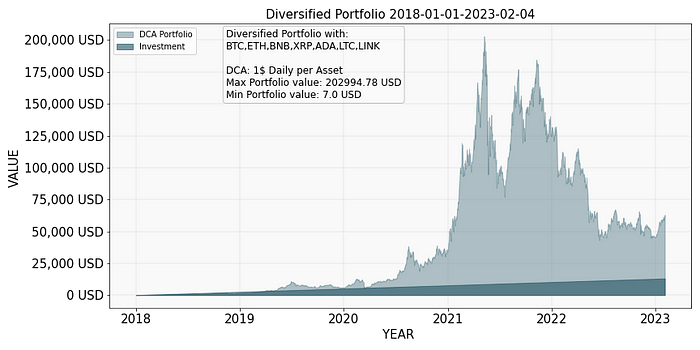

To mitigate these uncertainties, investors should consider diversifying their portfolios and implementing dollar-cost averaging (DCA) strategies. DCA involves investing a fixed amount of money regularly, regardless of market fluctuations. This approach helps smooth out the impact of price volatility and reduces the risk of buying at market peaks.

While the common advice for investments is ‘if it sounds too good to be true, it probably isn’t,’ Bitcoin has consistently defied skeptics over the past decade, providing remarkable gains for those who recognized its potential. Despite the ongoing volatility in this emerging industry, its long-term trajectory has consistently trended upward, establishing it as an attractive option for wealth creation.

The Next Halving and Price Prediction

The upcoming halving event is set for mid-2024. According to the Stock-to-Flow (S2F) model, it predicts Bitcoin’s price to fall within the range of $100,000 to $500,000 after the halving. While the recent price had temporarily dipped below the model’s projected price, a recent increase has once again aligned the trend within the standard deviation of the model’s projection.

DCA: A Prudent Approach for Investment Exposure

For individuals seeking exposure to the potential gains of the cryptocurrency market, while also managing risk, dollar-cost averaging (DCA) is a strategy worth considering. DCA involves investing a fixed amount of money at regular intervals, regardless of the market’s fluctuations. This strategy helps smooth out the impact of price volatility and averages out the purchase price, potentially minimizing losses during market downturns. Our philosophy emphasizes that for individuals who may not be seasoned traders, DCA stands out as a wise investment strategy, emphasizing the significance of spending time in the market rather than trying to time the market.

We want to highlight the backtesting results from earlier this year. They show that a basic portfolio with 7 assets, investing just $1 in each every day, can lead to significant profits within 5 years.

Comtrax’s DCA service, simplifies the process of automating DCA investments in a variety of assets. Users can set up recurring investments based on their desired frequency and amount, allowing them to accumulate crypto holdings over time without the need for active market monitoring.

As the cryptocurrency market continues to evolve, tools like Comtrax and the S2F model can provide valuable insights for investors seeking to navigate this dynamic space. While past performance is not necessarily indicative of future results, the S2F model’s historical accuracy and DCA’s risk mitigation strategies offer valuable frameworks for approaching investments with informed decisions.

Discover a world of investment possibilities with Comtrax. Our user-friendly and secure platform make investing easy and hassle-free. Sign up now at www.comtrax.ch.